The Five Forces of Porter framework is a rather useful tool to determine the attractiveness of an industry. Named after Michael E. Porter, the Five Forces of Porter framework dictates that there are five forces that determine the overall competitive intensity and attractiveness of a market. It is particularly helpful in evaluating whether or not a company should enter a particular industry. For that reason, it is very popular and widely used, for instance to analyse the industry structure of a company or its corporate strategy.

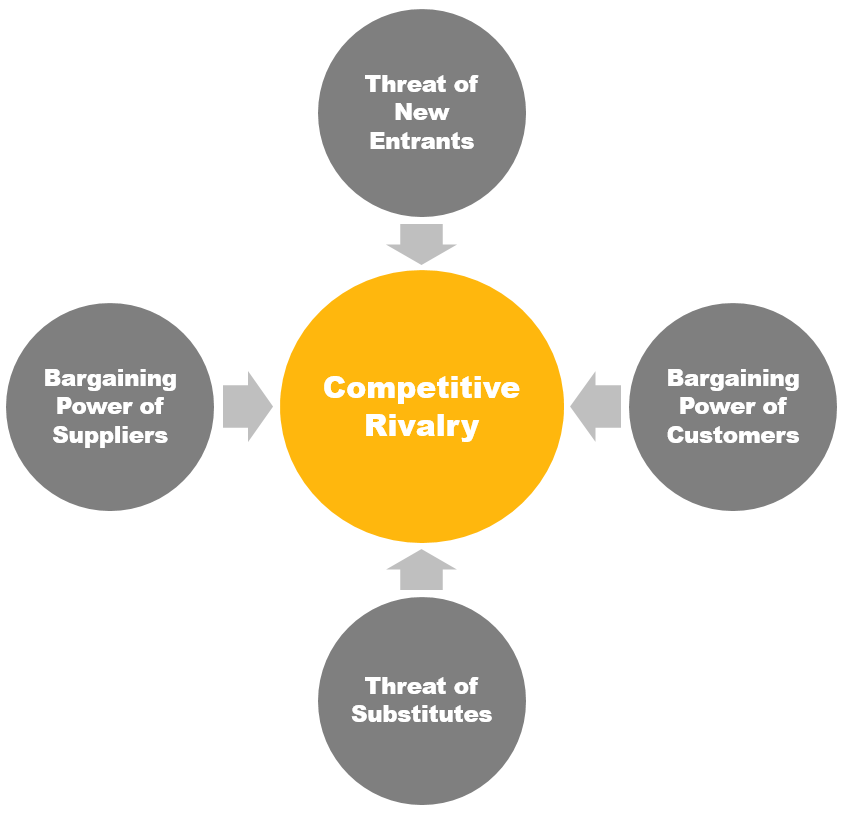

Porter defines five forces which provide a clear picture of the potential profitability of entering an industry. This is based on the concept that the five forces help to determine the competitive intensity, which in turn mirrors the attractiveness of the industry. An unattractive industry is one in which the overall effect of the forces reduces profitability. The most unattractive industry would be an industry with pure competition.

The framework can be applied to any segment of the economy to assess potential profitability and general attractiveness. In fact, the framework provides an explanation why different industries are able to sustain different levels of profitability.

Table of Contents

The Five Forces in the Five Forces of Porter Framework

The Five Forces of Porter Framework analyses five factors that shape every industry. After having investigated each of these factors, you should have a clear picture of the opportunities and threats provided by the industry.

- Competitive Rivalry

- Bargaining Power of Customers (Buyer Power)

- Bargaining Power of Suppliers (Supplier Power)

- Threat of New Entrants

- Threat of Substitutes

Five Forces of Porter Framework – Assessing the Attractiveness of an Industry

Competitive Rivalry

The most central factor in the Five Forces of Porter Framework is competitive rivalry. The reason for this is that all other factors impact competitive rivalry. So what do marketers need to consider?

Competitive rivalry is determined primarily by the following factors:

- Number and size of competitors (industry concentration)

- Competitor strategy

- Competitor resources (e.g. for advertising activities or new product development)

- Industry growth

- Exit barriers

- Share of fixed costs

- Differentiation (e.g. differences in prices, quality, etc.)

Threat of New Entrants

Clearly, there is a direct link between an attractive industry and the threat of new entrants: If an industry is perceived as attractive, new entrants are likely to appear. A larger number of competitors in turn will lead to lower profitability across the industry, which in turn may lower the attractiveness again.

Important criteria that influence the threat of new entrants comprise:

- Capital requirements

- Entry barriers (rights, patents, technology protection etc.)

- Access to inputs

- Learning curve

- Economies of scale

- Customer loyalty

- Government policies (to either encourage or discourage new entrants)

Threat of Substitutes

If customers can easily substitute your product or service for another, the threat of substitutes is high. This is not the same as switching to a different company with the same offering, but switching products entirely. For example, Pepsi is not a substitute to Coca Cola, but for somebody seeking primarily a caffeinated drink, coffee or green tea may be a substitute. The more products fulfilling the same need there are, the higher the chances your customers will be drawn to a substitute. How to confront this?

- Number of substitute products

- Perceived level of differentiation

- Switching costs (a cost to the buyer for switching to the alternative)

- Attractiveness of substitutes to buyers

- Price-performance trade-off of substitutes

Bargaining Power of Suppliers

Every company has suppliers, whether for raw materials, knowledge support or whatever else. Often, a lot of research and consultation is necessary to attain the best suppliers at the best price. For some companies, the choice of supplier has a significant impact on the business result, due to specialist knowledge, technology, quality, or simply prices. For others, just about any of the available suppliers may do the job. But what if there is very little choice of suppliers? The fewer suppliers fulfilling the company’s requirements there are, the more power they have over the company and the prices they can charge. Marketers should consider:

- Number of available suppliers (fulfilling the company’s requirements)

- Size of suppliers

- Switching cost (costs to both the company and the supplier for switching)

- Differentiation of inputs

- Impact of inputs on cost or differentiation

Bargaining Power of Customers

Also the customers can have power over the company. This is the case whenever they can exert pressure to companies, in particular pressure to lower their prices. If buyers have a large choice of products and companies to choose from, the power they have over the company is high as they can easily decide to switch the company. Equally, if the company depends on just a few large buyers, they have an extreme power over the company as one of them leaving may mean trouble for the company. The bargaining power of customers is determined by:

- Number of buyers and importance of one individual buyer for the company

- Price sensitivity

- Buyer volume

- Buyer information (what information about the market do customers have, and how much information is available to you on your buyers?)

- Differentiation of the company and its products

The table below summarizes key determinant factors for each of the five forces in the Five Forces of Porter Framework.

| Competitive Rivalry | |

| · Number and size of competitors (industry concentration)

· Industry growth · Exit barriers · Share of fixed costs · Differentiation |

|

| Bargaining Power of Suppliers | Bargaining Power of Customers |

| · Supplier concentration

· Switching cost · Differentiation of inputs · Impact of inputs on cost or differentiation · Presence of substitute inputs |

· Bargaining leverage

· Buyer volume · Buyer information · Price sensitivity · Product differentiation |

| Threat of New Entrants | Threat of Substitutes |

| · Entry barriers

· Access to inputs · Learning curve · Economies of scale · Capital requirements |

· Switching costs

· Attractiveness of substitutes to buyers · Price-performance trade-off of substitutes |