Once the company has analyzed its current business portfolio and determined which SBUs should receive more and which less investment, it must now shape its future portfolio. This is the second essential part of designing the business portfolio: Portfolio Planning.

By using the Boston Growth-Share Matrix portfolio analysis approach, the firm has learned what its current business portfolio looks like and which strategic business units should receive more and which others less attention to. But in an increasingly rapidly changing market environment, firms must prepare for the future.

Constant innovation is critical to survive in the market. If the firm wants to compete more effectively and satisfy stakeholders, it needs growth, but even more importantly, profitable growth. Therefore, we now focus on the part of designing the business portfolio that involves finding products and businesses the company should consider in the future. This is done by developing strategies for growth and downsizing. We call it Portfolio Planning.

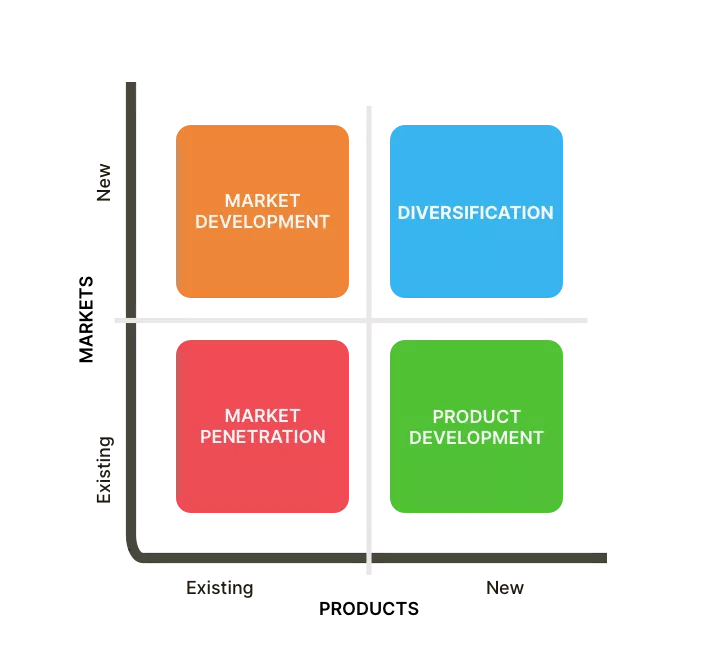

What do we need to do? We need to identify, evaluate, and select market opportunities as well as establish strategies for capturing those opportunities. The most useful and popular device for identifying these growth opportunities is Ansoff’s Product-Market Expansion Grid which you see below. This grid is a portfolio planning tool that identifies 4 strategies for future growth: market penetration, product development, market development, and diversification.

On the vertical axis, existing markets and new markets are differentiated. On the horizontal axis, existing products and new products are differentiated. This leads to four fitting portfolio planning strategies for each situation.

The 4 Product-Market Expansion Strategies for Portfolio Planning

Market Penetration

Let’s start with the Market Penetration strategy for portfolio planning. Companies can grow by better penetrating already existing markets with already existing products. This means that there is nothing really new: the firm takes a current product in a current market and just penetrates the market in a better way. As an example, we will look at a car manufacturer.

That company could take its already existing model X in an already existing market and improve its growth potential by adding modifications, colors, etc. Alternatively, it could offer discounts and promotions to drive sales. In other words, market penetration means nothing else than increasing sales of current products to current market segments without changing the product.

Market Development

For existing products, but new markets, the firm should choose a Market Development strategy. With that, it can expand its already current products to new, potentially profitable markets. This can simply be accomplished by identifying and developing new market segments for current products. To return to the previous example, the car manufacturer could take its existing model X and target a new market segment with it: instead of only older generations, the firm may now aim at younger segments as well.

Product Development

Next, the company can use a Product Development strategy for existing markets, but new products. The company growth would then be achieved by offering modified or new products to current market segments. In our example, the car manufacturer could design a new product for its market segment consisting of older generations. In addition to the model X, it could add a model Y. It could also choose to modify model X in its portfolio planning.

Diversification Strategy

Finally, company growth can be accomplished by a Diversification strategy. This applies to new products and new markets. Therefore, the company starts up or buys businesses beyond its current offerings and markets. For example, the car manufacturer from our example might decide to enter a new market by acquiring a clothing brand. This would be a completely different market for the firm as well as a completely different product line. However, the clothing brand could be used to promote and extend the identity of the car brand. Diversification can take two ways: related and unrelated SBUs. If the car manufacturer adds motorbikes to its portfolio, you can easily see a link between its already existing offerings.

Downsizing – Crucial Component of Portfolio Planning

As said before, company growth is necessary for surviving in business. Yet, only developing strategies for growing their business portfolios is not sufficient. Instead, the company must prepare and carry out strategies for downsizing as well. Downsizing is as necessary as growth for sound portfolio planning.

Downsizing means nothing else than reducing the business portfolio. How? By eliminating products or SBUs. The company should eliminate those strategic business units that are not profitable or no longer fit the company’s overall strategy.

For example, the market environment might just change, leading to products or even whole markets that are not profitable for the company anymore. Or the firm might have entered too many international markets and now lacks experience and capabilities.

Then, a company may abandon some SBUs and focus on the most promising ones, to concentrate the limited resources on the strongest products. This does especially hold in difficult economic times. But products or business units might also simply age and die.

Downsizing can be accomplished by pruning, harvesting, or divesting SBUs. The aim should always be to focus on growth opportunities, instead of wasting energy by trying to salvage fading ones.

With a balanced business portfolio, both now and in the future, the company can make sure that it will always be able to create superior customer value. Only then, it can survive in the dynamic market, based on a perfect fit between the company’s strengths and weaknesses and opportunities in the environment.